Acquisition project | NovaX by Nova Benefits

NovaX by Nova Benefits is a retail insurance arm to their existing b2b insurance clients. Nova Benefits has about 80k+ employees (or users) currently enrolled on their portal. NovaX is an exclusive service that helps these folks identify the right health, term life, motor and travel insurance policies for them, like a one-stop solution. NovaX works on a couple of core values like no-spam, ethical and information-driven consultations to help people identify the right plan as per their profile, facilitate the purchased process and provides claim assistance at no additional cost.

Product Flow Analysis:

- Via the Nova Portal

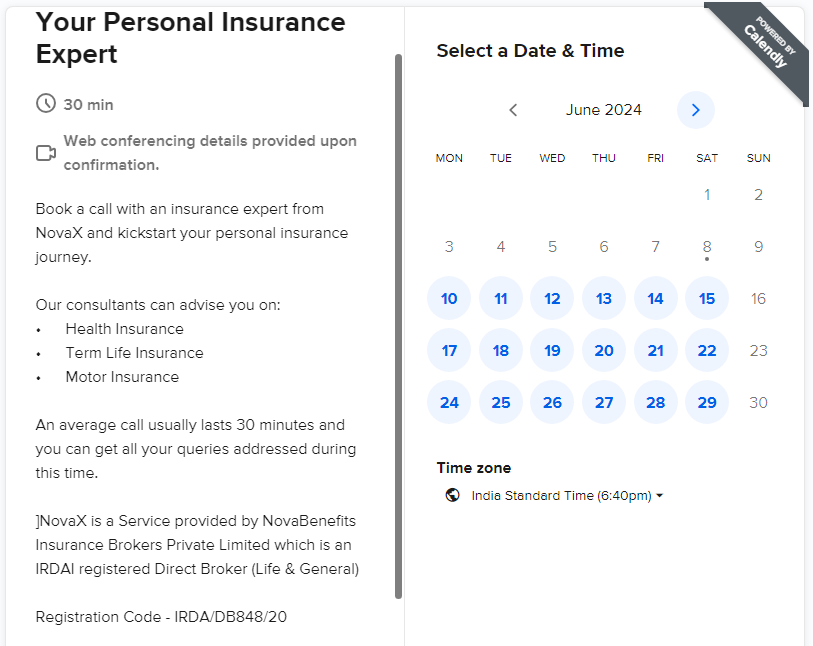

Once clicked on this benefit card, it redirects them to WhatsApp where they can ask their queries or schedule a consultation call. The flow is as follows:

Once the consultations are completed, we send out the desired recommendations as below-

2. Email campaigns

Once the user has filled out the linked form where we collect their basic details, our team members reach out to them to schedule a consultation call.

Understanding the user:

My ICPs are as below:

ICP 1 | ICP 2 | ICP 3 | ICP 4 | ICP 5 | ICP 6 | |

|---|---|---|---|---|---|---|

Insurance type | Health | Health | Health | Term | Term | Term |

Age | 35 | 28 | 24 | 50 | 38 | 27 |

Gender | Any | Any | Any | Any | Any | Any |

Location | Metro | Smaller metros | Smaller metros | Smaller metros | Metro | Smaller metros |

Profession | Head of operations | Designer | Sales | Consultant | Software engineer | Legal Associate |

Salary | 50-60LPA | 30-35LPA | 10-12LPA | 25-30L | 1-1.5 cr | 25-30L |

Social media preferred | ||||||

Marital status | Married | Married | Unmarried | Married | Married | Unmarried |

Familial status | Spouse and 2 kids as dependents | Spouse | No dependents | Spouse and one child as dependents | Only spouse | No dependents |

ICP Prioritization- My ideal ICPs would be ICP 1 for Health Insurance and ICP 5 for Term Insurance.

- Appetite to pay

- Family-oriented and hence have a higher likelihood of getting an insurance to protect loved ones

Influencers - Desire to provide comprehensive cover for family members Reputation of the insurers with a high claim settlement ratio Financial Advisors or wealth management advisors recommend having an insurance in place

Blockers- Lack of time to research and compare Complex processes (especially for term insurance) due to physical medical checkups and financial underwriting Distrust in insurance companies due to mis-selling practices

Competitor Analysis:

Closest competitor would be PlumX Our strengths: We can provide end-to end solutions for health, term, travel and motor, whereas PlumX only works on Term Weaknesses: They have visibility on their website - as an exclusive service with FAQs https://www.plumhq.com/term-life-insurance and we don’t have an online presence yet (outside of the portal)

Part 2-

TAM: The TAM is the total corporate count in India (with 100+ employees) x average size per corporate x average margin per sale As per resources, there are about 15000 corporates in India with the ideal employee strength Average size per corporate is about 1400 people Average margin per sale is about INR 2000 (amalgamation of multiple products like health insurance, term life insurance, super top ups and travel insurance) The TAM from a revenue standpoint is 15000x1400x2000 = INR 4200 cr

SAM- 80k users of the Nova Portal

To segregate it further-

- Leadership: 10% (8000 people)

- Middle management: 30% (24,000 people)

- Entry-level / Associates: 60% (48,000 people)

Let’s assume that some people are already adequately covered and do not need any insurance.

Assumptions: 50% in Leaderships are already covered. Middle management has 40% who are fully covered, whereas on an entry-level, there would be only 20% of the people who are fully covered. This bring us to- 4000 in leadership 14400 in middle management 38400 in entry-level roles 56,800 that are uncovered.

To segment this further:

Cohort | Not eligible | Unaware | Can’t afford |

|---|---|---|---|

Leadership | 15% or 600 | 5% or 200 | - |

Middle management | 15% or 2160 | 30% or 4320 | 10% or 1440 |

Associates | 10% or 5680 | 40% or 15360 | 40% or 15360 |

Total number | 8440 | 19880 | 16800 |

Unaware but can afford problem can be solved through marketing. 19880X 2000 = 3.97 cr

SOM- Let’s assume there are 10 people who Competition: PolicyBazaar attribution - 3 people out of 10 because of brand visibility Ditto- 2 people out of of 10 because of brand value NovaX - Reaslistically can immediately obtain the 50% of the market bringing us to 9940 individuals

Revenue would be 9940x2000 = 1.98cr

Core Value Prop: Transparent, expert guidance for all your insurance needs through your corporate benefits platform

Acquisition channels- As my product is in the PMF stage, there are multiple acquisition channel options that are cheaper, faster and feedback-driven.

- Email Campaigns

- Insurance edu-series

- Term insurance price hikes before birthday

- Case study driven campaigns for health insurance (e.g: percentage of diabetics in India and how it impacts their purchase)

- Webinars and Offline sessions

- Partnerships with HRs

- Once the account is onboarded, we can ask the key-account manager to speak to HR for a consultation call wherein we can help them identify the right plans and if they’re currently insured, we can also help them with a detailed evaluation of their policy. This is a highly feedback driven channel.

- Onboarding calls

- Once the entire purchase processes are completed by an org, we conduct onboarding calls with all their employees to give them a walkthrough of what’s covered and what’s not covered under their GMC, helping them with an escalation matrix and giving a walkthrough about other benefits offered by Nova free of cost. Highlighting these during calls where a high strength of people have joined can help give them an understanding that we will be their one stop solution.

- Nova Portal

- NovaX is a service that can only be used via the Nova portal/app. Having more visibility on the Nova Portal can help bringing in leads organically.

- Employee Engagement Events like health checkup camps for employees

Source | Cheap | Fast | Feedback-driven |

|---|---|---|---|

Email Campaign | Yes | Medium | Medium |

Webinars | Yes | High | Yes |

HR partnerships | Yes | Low | Yes |

Onboarding calls | Yes | Low | No |

Nova Portal | Yes | High | Yes |

Employee Engagement Events | Yes | Medium | Yes |

Top 2 preferred acquisition channels:

Experiment 1: Webinars Hypothesis: Interactive webinars on personal finance and insurance topics will build trust, educate potential customers, and lead to higher conversion rates for NovaX products.

Implementation Plan:

Topic Selection: Host monthly webinars on topics like "Personal Finance 101," "Understanding Health Insurance," and "Benefits of Term Insurance."

Scheduling and Promotion: Schedule webinars during peak engagement times (e.g., evenings or weekends). Promote through email campaigns, Nova Portal banners and HR partnerships.

Content Creation: Develop detailed presentations and include real-life case studies, statistics, and interactive Q&A sessions. Feature guest speakers such as financial advisors and industry experts.

Engagement: Encourage live Q&A and interactive polls during the sessions. Offer post-webinar downloadable resources (e.g., guides).

Follow-up: Send follow-up emails with a brief of the webinar, additional resources, and a feedback survey.

Feedback Loop: Analyze survey responses to identify common questions, concerns, and areas for improvement. Use feedback to refine future webinar topics and formats.

Metrics to Track:

Number of registrations and attendees Engagement during the webinar (questions, polls) Post-webinar survey responses Conversion rates from attendees to customers

Experiment 2: Nova Portal Visibility Hypothesis: Increasing the visibility of NovaX on the Nova Portal will drive organic leads and conversions by leveraging existing user traffic.

Implementation Plan:

Banner Ads: Place prominent banners on the Nova Portal and app homepage promoting Novax services. Design banners to highlight key benefits (e.g., "Personal Insurance Simplified - Click here to book a consultation call").

Interactive Tools: Implement an interactive term insurance calculator next to the GTL card. Include a prompt like, "Is your coverage sufficient to protect your family? Find out now." Add a slider for term coverage estimation and a CTA to schedule a consultation call.

Surveys on the Nova Portal: Use Posthog to deploy short surveys on the portal to gather user insights and preferences. Questions can include insurance needs, awareness, and satisfaction levels.

Content Integration: Embed educational content such as articles, videos, and FAQs about insurance on the portal. Link to relevant webinar recordings and upcoming sessions.

Feedback Loop: Monitor user interactions with banners, tools, and content. Collect feedback through surveys and user behavior analytics. Use insights to optimize banner placement, tool functionality, and content relevance.

Metrics to Track:

Click-through rates on banners and tools User engagement with interactive tools Survey response rates and insights Conversion rates from portal interactions to customers

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.